News Release from American Clean Power Association (ACP)

Wind Industry Profile of

Fact Check: What critics are getting wrong about wind power during the tax reform debate

The reality is that tax credits for wind energy are already in the midst of an orderly phaseout and will be gone after 2019. In the meantime, this policy is achieving its goals: creating tens of thousands of new jobs, triggering massive investment in rural America, and generating affordable electricity – unless Congress breaks its promise and cripples the industry instead.

First, some background.

In December 2015, Congress reached a bipartisan agreement to end the uncertainty that had plagued the wind industry and gradually phase out the PTC over five years. It was part of a bargain that also allowed U.S. oil exports.

Essentially, wind would go first on tax reform.

The business certainty that deal created spurred a new wave of investment. Companies signed manufacturing and construction contracts worth tens of billions of dollars, and hired tens of thousands of new American workers. Wind added jobs nine times faster than the overall economy, and wind turbine technician and solar installer have become the country’s two fastest growing jobs from 2016 to 2026, according the U.S. Bureau of Labor Statistics.

Fast forward to November 2017. The U.S. House releases its tax reform bill, and instead of honoring the deal from two years before, proposes deep cuts in the value of the remaining tax credits and new retroactive rules to qualify for them that companies cannot go back in time to comply with.

If it becomes law, that would change the rules in the middle of the game, threatening projects already underway with cancellation. It has already put 60,000 U.S. jobs at risk and jeopardized $50 billion of private investment in new infrastructure. Bloomberg New Energy Finance estimates over half of the wind farms scheduled to be built between now and 2020 could lose their financing unless this is fixed. Mike Garland of Pattern Energy, a leading wind developer, called it “cruel and unusual punishment.”

Fortunately, the Senate’s version of tax reform honors the terms of the PTC phase-out. It would let the wind industry keep hiring and spending in small towns that need more opportunities.

But the spread of false information continues. Here’s a roundup of a few egregious examples, followed by a dose of reality.

Wall Street Journal editorial board: Tax reform is a chance to tell the wind racket to get off the dole but it isn’t clear Republicans are up to the task.

Reality: The Journal’s editorial board is asking for something that already happened two years ago—the PTC is phasing down, and will be gone after 2019.

And what they’re calling a “racket” happens to employ over 100,000 Americans across all 50 states, and keeps more than 500 U.S. factories busy churning out wind-related parts. It generates more than 30 percent of the electricity in Iowa and Kansas, and more than 10 percent in a dozen other states. There is now enough installed wind capacity in the U.S. to power 25 million homes, making it an indispensable part of our electric grid.

Merrill Matthews, The Hill: Scaling back or ending renewable energy and electric vehicle tax breaks, as the House Republican plan does, would come closer to putting renewable energy on a level playing field with fossil fuels, while saving the government money.

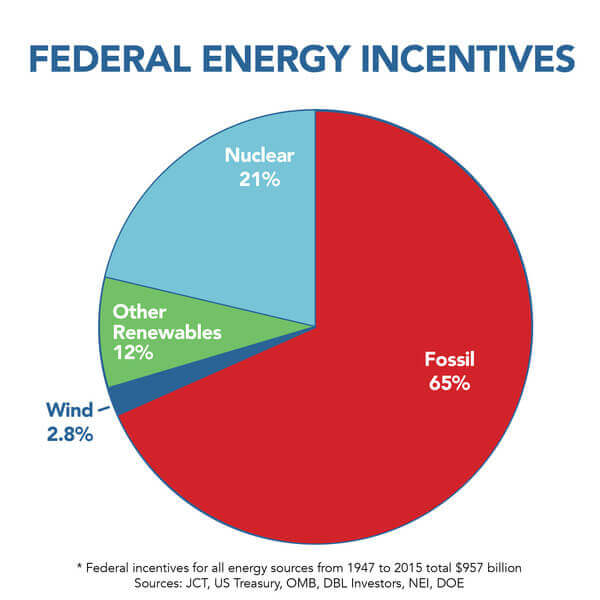

Reality: Virtually all sources of energy have incentives in the tax code, and most of the fossil fuel incentives are likely to continue even as wind voluntarily gives up its main incentive.

Wind, coal, nuclear, gas and solar plants all cost a lot of money up front to build. That means developers need access to capital from investors. Each uses various tax and regulatory structures to gain access to the funds they need to break ground.

Coal and gas can use a Master Limited Partnership, an investment vehicle that does not have to pay corporate taxes and can attract a large number of investors. That gets them access to capital at low interest rates, which helps build more power plants.

Nuclear plants for 60 years have relied on a form of public insurance under the Price-Anderson Act. Investor-owned utilities, the most common owners of nuclear plants, cannot get insurance on the private market that would cover a meltdown. The Price-Anderson Act caps a nuclear plant owner’s liability in the event of a disaster, with the federal government covering the rest of the exposure. That makes such plants more attractive to investors.

For wind and solar projects, the Production Tax Credit or alternative Investment Tax Credit have boosted their attractiveness to investors as a low-risk revenue stream, so they can accumulate the capital to start building. Yet wind has received less than three percent of all energy incentives since 1950.

Sen. Lamar Alexander: Wind blows only 35 percent of the time… so until there’s some way to store large amounts of wind power, a utility still needs to operate nuclear, gas, or coal plants to cover when the wind doesn’t blow.

Reality: The average wind turbine generates useful amounts of electricity 90 percent of the time. Grid operators have always balanced changes in supply and demand, and balancing wind is no different. Changes in wind output are gradual and can be predicted up to 24 hours in advance, whereas conventional plants can unexpectedly go offline, creating far more complicated and costly problems for grid operators.

Sen. Alexander is confusing wind generation with what is called the “capacity factor,” which is the percentage a plant operates year-round of its theoretical maximum capacity. New wind farms average capacity factors over 40 percent, roughly the same as conventional plants, which don’t run flat-out 24 hours a day, 365 days a year either. But that doesn’t mean they only generate electricity 40 percent of the time. Rather, some days they’re generating right at the max, other days somewhere in between, but rarely are they standing still.

Think of it like driving on the highway. Even though the speed limit may be 65 MPH, your car won’t hit that maximum speed at all times due to traffic and other factors. But that also doesn’t mean your car is standing still when you’re not hitting 65—you’re still moving (hopefully).

Eduardo Porter, New York Times: The Wind Catcher farm in Oklahoma occupies 2,400 times as much land as Diablo Canyon [nuclear plant] but produces half as much energy.

Reality: This is an apples-to-oranges comparison of different energy sources. Mining and waste storage add to a conventional power plant’s footprint, and a nuclear power plant fully occupies the land it sits on. Meanwhile, land used for wind farms is multi-purpose.

The average wind project leaves 98 percent of land left undisturbed, making it free for other uses like farming and ranching. The proposed Wind Catcher project will use just a tiny portion of the land area its turbines are installed across, with overwhelming majority still free for farming or ranching.

Robert Bryce, New York Post: Multibillion-dollar subsidies for Big Wind are also fueling widespread destruction of American wildlife.

Reality: Wind energy has a legacy of care for the environment to uphold, and does far more to safeguard nearby wildlife than virtually any other industry. Wind turbines have the lowest impacts on wildlife and their habitats of any utility-scale power plant, according to the New York State Energy and Research Development Authority. A typical wind turbine is struck by fewer than one bird per month, which compares favorably to a tall building; overall, wind energy is responsible for less than a hundredth of one percent of human-related bird deaths.

Bryce has a long history of spreading false and misleading information about wind, even after he has been corrected, and he has ties to anti-renewable special interests. More than 50 journalists and educators once submitted a letter to the New York Times urging its public editor to do a better job disclosing conflicts of interest from op-ed writers like Bryce.

There’s more to a thriving business environment than lower taxes. Businesses also need stability to confidently invest and hire workers. By pulling the rug out from under the wind industry, the House bill would upend the stability created by the 2015 phase-out. The Senate version, on the other hand, does right by U.S. wind workers and all the rural Americans who are counting on this new cash crop to revitalize their communities. Contact your representatives today to let them know you support American wind workers.

- Source:

- AWEA Blog - Into the Wind

- Author:

- Greg Alvarez

- Link:

- www.aweablog.org/...

- Keywords:

- AWEA, Blog, facts, wind energy, tax bill, USA