News Release from windfair.net

Wind Industry Profile of

Endangering global energy transition: oil, gas, now metals, too?

The war in Ukraine is already a human catastrophe. And it could also prove disastrous for climate protection, as it slows down the global energy transition. This is partly because various countries are now frantically trying to reduce their dependence on Russian fossil fuels such as gas and oil and are instead relying on other sources of supply. In Germany, for example, there is discussion of at least a delayed coal phase-out and efforts are being made to import fracked gas from the U.S., which is particularly harmful to the environment during production, while in Australia there have been calls to delay efforts to reduce emissions.

But there could also be - new - problems with the necessary expansion of renewable energies. Both Russia and Ukraine are major suppliers of metals needed to produce environmentally friendly technologies like solar cells, wind turbines and batteries for electric vehicles. The war currently poses a significant threat to global supplies of copper, nickel, platinum, palladium, aluminum and lithium.

So far, imports of these metals from Russia have not been affected by the sanctions, but this development has not been ruled out. Thus The Conversation recalls how sanctions were imposed on Russian aluminum producer Rusal in 2018, causing global prices to skyrocket.

Russia accounts for 7 percent of the world's mined nickel - a metal needed to make batteries for electric vehicles. The current conflict reportedly drove nickel prices up 250 percent in 48 hours last week.

Ukraine, on the other hand, is the world's largest supplier of noble gases. These include neon and krypton, which are used in the manufacture of semiconductor chips. The latter are an important component of all electronic systems, including those found in automobiles, renewable energy machinery and other technologies. The annexation of Crimea by Russia in 2014 already led to a rise in neon prices. And the effects of war are already being felt at present, with a shortage of semiconductors and chips already leading to production cuts and shutdowns in Western factories.

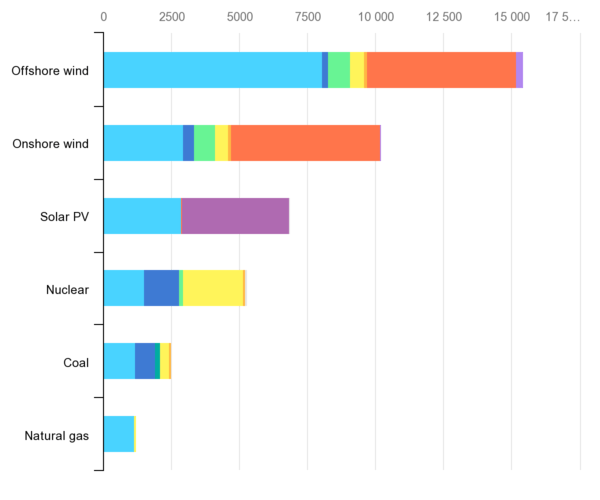

The International Monetary Fund stated as early as December 2021, "A typical electric vehicle battery pack, for example, needs around 8 kilograms (18 pounds) of lithium, 35 kilograms of nickel, 20 kilograms of manganese and 14 kilograms of cobalt, while charging stations require substantial amounts of copper. For green power, solar panels use large quantities of copper, silicon, silver and zinc, while wind turbines require iron ore, copper, and aluminum."

Minerals used in clean energy technologies compared to other power generation sources (Image: IEA)

Difficult, because there is no quick solution to develope new sources of supply: the International Energy Agency (IEA) i.e. points out that it takes about 16.5 years from approval to mining in such a mine.

The shift to a clean energy system will lead to a huge increase in demand for these minerals. In an IEA scenario that meets the goals of the Paris Agreement, their share of total demand will rise significantly over the next two decades to more than 40 percent for copper and rare earth metals, 60-70 percent for nickel and cobalt, and nearly 90 percent for lithium. Electric vehicles and battery storage have already displaced consumer electronics as the largest consumer of lithium and will replace stainless steel as the largest end user of nickel by 2040.

So what needs to be done to minimize the threat of dependence on these raw materials? Forbes' Sam Bose, who worked in the mining industry for over a decade, calls for the use of technologies such as artificial intelligence, advanced chemistry and inverse production processes for recycling and new processes to maximize the net production of metals from existing assets across the value chain (mining, refining, recycling).

But again, there don't seem to be any quick fixes.

- Author:

- Katrin Radtke

- Email:

- press@windfair.net

- Keywords:

- Ukraine, Russia, war, metal, rare earth, oil, gas, raw materials, global, energy transition, renewable energy, dependence, production, mining