News Release from Bloomberg New Energy Finance (BNEF)

Wind Industry Profile of

1H 2022 Sustainable Finance Market Outlook

Given the proliferation of ESG into financial products and stakeholder buy-in, many regions are now examining how to standardize the market via policies such as taxonomies.

Image: BloombergNEF

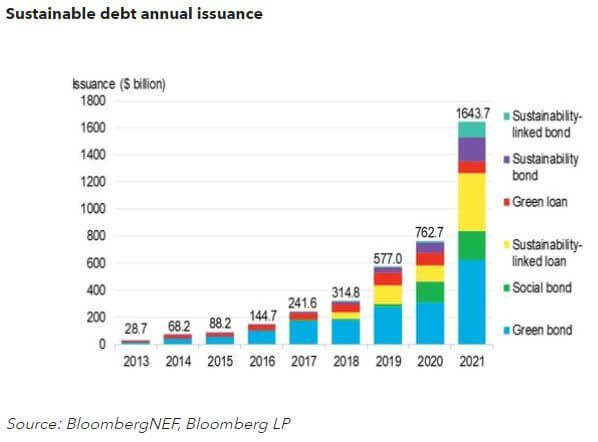

Green bonds doubled in issuance between 2020 and 2021, with volumes reaching more than $620 billion. Social and sustainability bonds together reached a record $400 billion in issuance in 2021, boosted by government bonds, largely from supranationals. However, social bonds began to see a slip in offerings in 2H compared with the first half of the year, largely due to the removal of some key Covid-19 relief program financing.

Net flows into ESG ETFs rose to a record $128 billion in 2021. However, more labeling standards are needed, as sustainable criteria are inconsistent. Global variations such as these have led to a true ‘taxomania’ developing globally. After the EU pioneered its Taxonomy for defining sustainable activities, other countries including the U.K., Singapore and South Africa have been inspired to establish their own, similar classification systems.

Transition-labeled finance has largely failed to take off, as issuers are unclear about the meaning and investors are skeptical about greenwashing. A more popular alternative for heavy-emitting industries has been sustainability-linked loans and bonds, which were the fastest growing themes in the ESG fixed income market in 2021. Together, these reached more than $530 billion – four times the volume offered in 2020.

- Source:

- BloombergNEF

- Author:

- Press Office

- Link:

- about.bnef.com/...

- Keywords:

- BloombergNEF, debt, sustainable, COP26, outlook, market, policy, taxonomies, lasgow Financial Alliance for Net Zero, emissions, government, boost