Annual report 2017 - Strong results support Ørsted's green transformation

We increased our share of renewable energy by 14 %-points to 64%. Our target is for at least 95% of our heat and power generation in 2023 to be green.

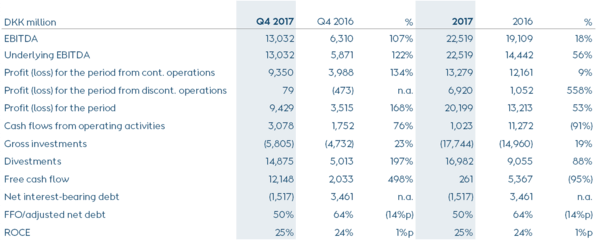

Development in financial performance in 2017

- Our underlying operating profit (EBITDA) adjusted for non-recurring items was 56% higher than in 2016.

- Wind Power's EBITDA increased by 74% to DKK 20.6 billion. The farm-downs of 50% of Walney Extension and Borkum Riffgrund 2 contributed significantly to this. Earnings from our offshore wind farms in operation increased by 45%.

- Return on capital employed (ROCE) increased to 25% in 2017 from 17% in 2016, disregarding non-recurring income from gas contracts totalling DKK 4.3 billion in 2016.

- The net profit for the continuing part of the group increased by DKK 1.1 billion to DKK 13.3 billion.

- The Board of Directors recommends that dividend payments be increased by 50% from DKK 6 to DKK 9 per share (DKK 3.8 billion in total).

CEO Henrik Poulsen says: "In 2017, we took decisive steps towards completing our strategic transformation to a green energy company. We continued our build-out of green energy generation from offshore wind and biomass, we divested our oil and gas business, and we made the decision to be coal-free by 2023. It was also the year when we won projects both in Germany and the UK, and for the first time offshore wind was able to compete on cost with new-builds of coal- and gas-fired power stations.

2017 was a financially strong year for us. We delivered our highest operating profit ever and achieved delivered performance across our business units. The farm-downs of Walney Extension and Borkum Riffgrund 2 also prove that our partnership model remains very attractive for institutional investors.

We are making good progress in the strategic expansion of our offshore wind business. In November, a panel of experts under the Taiwanese environmental authorities recommended granting environmental permits to our four offshore wind projects in Greater Changhua. In December, we submitted our first bid for an offshore wind farm project in the USA. The bid concerns the Bay State Wind project in Massachusetts, where we want to construct an offshore wind farm together with our partner, Eversource Energy.

In our utility business, we inaugurated the biomass-converted Skærbæk Power Station, continued rolling out smart meters in Danish homes and introduced differentiated tariffs in Radius' grid. This supports the green transformation by incentivising our customers to smoothen their power consumption thereby allowing for a more efficient use of green energy generation and the distribution grid.

In the coming years, we will pursue our objective of continued build-out of offshore wind. We also want to make our utility business greener, create a smart power distribution grid and improve our customeGermany, r experience through digitisation and innovation of our products. In addition, we are working to expand our portfolio of long-term growth opportunities within green energy. For instance, we have established a new unit to explore energy storage and solar PV projects, and we are also looking more closely at the market for onshore wind."

Financial key figures for 2017 and Q4

Outlook 2018

From 2018, we have decided to change our guidance method.

In the future, our guidance will only include the effect from existing offshore wind partnership agreements. Previously, our outlook also included the effect from partnership agreements which we expected to conclude during the year. That made our outlook particularly sensitive to the timing of farm-downs in Wind Power as well as the distribution of income between the years. In 2017, EBITDA from the new partnerships concerning Walney Extension and Borkum Riffgrund 2 totalled DKK 9.8 billion.

EBITDA (business performance) excluding new partnership agreements is expected to be DKK 12-13 billion in 2018 compared with DKK 12.7 billion in 2017.

We still expect a 50% farm-down of Hornsea 1, either in H2 2018 or in 2019. Should the divestment materialise in 2018, EBITDA including new partnerships is expected to be higher than the DKK 22.5 billion achieved in 2017.

Gross investments for 2018 are expected to amount to DKK 16-18 billion, reflecting a high level of activity related to our offshore wind farm projects, the biomass conversion of Asnæs Power Station as well as the installation of smart meters.

- Source:

- Ørsted

- Author:

- Press Office

- Link:

- orsted.com/...

- Keywords:

- Ørsted, annual report, 2017, green transformation, offshore, onshore, outlook