Strong strategic progress and raised outlook for the year

Agreement on farm down of 50% of the German offshore wind farm Borkum Riffgrund 2 to Global Infrastructure Partners

First power from Race Bank and inauguration of the Burbo Bank Extension and Gode Wind offshore wind farms

Partnership agreement with US-based Dominion Energy on offshore wind project in Virginia

-

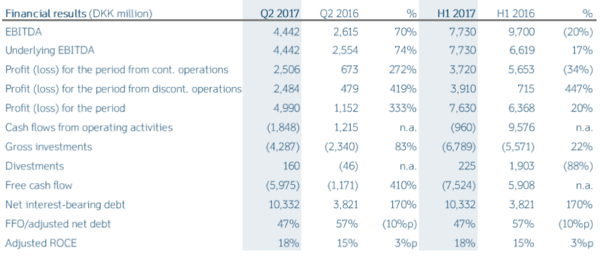

Operating profit (EBITDA) increased by DKK 1.8 billion and amounted to DKK 4.4 billion in Q2 2017

-

Underlying operating profit (EBITDA) rose by 74% due to higher earnings from ramp up of new offshore wind farms as well as high wind energy content. Furthermore, earnings increased from partnership agreements as Q2 2017 was positively impacted by gains related to the farm down of 50% of Race Bank

-

Return on capital employed (adjusted ROCE, last 12 months) was 18% compared with 15% at the end of June 2016

-

Cash flow from operating activities amounted to DKK -1.8 billion in Q2 2017, a decrease of DKK 3.1 billion compared with the same period last year. The decrease was primarily due to early settlement of intra-group hedging contracts related to the oil and gas business as well as more funds tied up in working capital due to a high level of construction activity on offshore wind farms

-

Gross investments totalled DKK 4.3 billion and related primarily to the construction of Walney Extension, Race Bank and Hornsea 1 in the UK as well as Borkum Riffgrund 2 in Germany

-

Net debt increased by DKK 3.8 billion in Q2 2017 and amounted to DKK 10.3 billion by the end of June 2017.

DONG Energy (Nasdaq OMX: DENERG) is one of Northern Europe's leading energy groups and is headquartered in Denmark. Around 6,500 ambitious employees develop, construct and operate offshore wind farms, generate power and heat from our power stations as well as supply and trade in energy to wholesale, business and residential customers. In addition, we produce oil and gas, and a process has been initiated to divest this business unit. The continuing part of the Group has approximately 5,800 employees and generated revenue in 2016 of DKK 61 billion (EUR 8.2 billion). Read more at www.dongenergy.com.

Commenting on the interim financial report, Henrik Poulsen, CEO and President, said: ”H1 showed strong strategic progress supplemented by good financial and operating results. Our expectations for partnership income in H2 2017 have increased, as we complete the divestment of 50% of Borkum Riffgrund 2 in 2017 instead of 2018. This means that we have raised our outlook for the Group’s operating profit (EBITDA) for 2017 to DKK 17-19 billion from previously DKK 15-17 billion, corresponding to an underlying growth of 18-32%.

In May and June, we inaugurated the UK offshore wind farm Burbo Bank Extension and the German offshore wind farms Gode Wind 1 and 2. Furthermore, in May we produced the first power from Race Bank, which is expected to be commissioned in Q1 2018. Our offshore wind farms under construction are progressing according to plan. We are also continuing our efforts to expand our portfolio of offshore wind projects for construction after 2020. In July, we entered into a partnership agreement with the US-based energy company Dominion Energy concerning a development project off the coast of Virginia. The project will initially involve construction of a 12MW demonstration plant, which may pave the way for future cooperation on further offshore wind development in Virginia.

We expect to submit a bid in the UK auction for the Hornsea 2 project on 14 August, and we expect to know the outcome of the auction in September. The deadline for submitting bids in the auction in Massachusetts, USA, is in the second half of December this year, and we expect to know the outcome of this auction in mid-2018 at the latest.

We expect to commission the first commercial REnescience plant in Northwich in the UK, turning unsorted waste into green energy and recyclable materials, during Q3 2017. The plant is still in the ramp up phase, and the coming months will be devoted to optimising and monitoring production and quality, while working to mature additional REnescience projects. Our pipeline focuses on opportunities in the UK, the Netherlands and Malaysia.

On 24 May, we announced an agreement to divest our oil and gas business to the British chemical company INEOS. The agreement is awaiting approval by the authorities in Norway, Denmark and the UK as well as other third parties. We expect the transaction to be closed by the end of Q3.

Within one to two years we will likely have excess investment capacity compared to the target rating of BBB+/Baa1, assuming the current dividend policy, the current farm down model, the current Wind Power build out plan as well as the ambition of a 1 GW per year offshore wind build out from 2021-2025. The likely excess investment capacity materialises as more and more Wind Power assets come on line and start generating cash flow and has recently been positively impacted by the experienced decline in the build out cost per MW (LCoE).

Value-enhancing, green growth opportunities beyond the current investment plan will be explored against tight strategic and financial criteria. This could include additional opportunities within offshore wind – which remains our core focus – as well as other renewable technologies and within our downstream, customer-facing business. After the farm down of Borkum Riffgrund 2 and the expected farm downs of Walney Extension and Hornsea 1, we will only consider farm downs as long as they are value creating in their own right.

Any excess financial headroom will be returned to shareholders in a disciplined manner through increased annual dividends and/or share buyback.

In recent years, our employees have made an outstanding contribution to transforming DONG Energy from a Danish company primarily focused on gas, oil and coal to being a global leader in renewable energy. They continue to pursue profitable, long-term growth and deserve huge recognition for their entrepreneurial spirit, diligence and hard work.”

Outlook for 2017

On 7 August 2017, we raised our EBITDA guidance (business performance) from DKK 15-17 billion to DKK 17-19 billion. This corresponds to an underlying growth of 18-32%.

The outlook for gross investments is unchanged relative to the annual report for 2016 and is still expected to amount to DKK 18-20 billion.

Significant events after the interim financial report for Q1 2017:

-

In May, we achieved first power at Race Bank and inaugurated the Burbo Bank Extension offshore wind farm. In June, we inaugurated the Gode Wind 1 & 2 offshore wind farms

-

In May, we entered an agreement to divest the oil and gas business to INEOS

-

In June, we decided to convert the Asnæs Power Station from coal to wood chips. The conversion is expected to be completed by the end of 2019

-

In July, together with Siemens, we agreed to divest A2SEA to Belgian GeoSea

-

In July, we entered a strategic partnership with Dominion Energy to construct two 6MW turbines off the coast of Virginia, which may pave the way for future cooperation

-

In August, we signed an agreement to divest 50% of Borkum Riffgrund 2

- Source:

- DONG Energy

- Author:

- Press Office

- Link:

- www.dongenergy.com/...

- Keywords:

- DONG Energy, outlook, profit