News Release from windfair.net

Wind Industry Profile of

The World of Offshore Wind Energy - Looking at other players

By the end of 2012, the cumulative installed capacity of offshore wind farms had reached an impressive 5,410 megawatts.

The move to offshore wind energy gained serious traction in 2010 when 999 megawatts were added across the world. In 2011 and 2012, this figure grew to 1,033 and 1,292 megawatts respectively.

Of late we at w3.windfair.net have concentrated on bringing our readers the latest news of new windfarms being erected in either Germany, Denmark or the United Kingdom. In doing so we have neglected a few interesting developments in other countries, of which we would now like to present a short overview of implementation status and political framework in each of these countries respectively. Leaving out Germany and the UK and China in Asia, we will first summarize other EU countries with great offshore wind energy potential and then move over to international players, where in some cases one would not expect any activities in this field.

Other European Countries with offshore ambitions

United Kingdom

Implementation status

The UK has great offshore potential because of its island location. There are numerous zones both in the North and the Irish Sea as well as in the English Channel which are available for the construction of offshore wind farms. As at the end of 2013, the UK was the largest global forerunner in the use of offshore wind energy with approximately 1,080 offshore wind energy plants and a total capacity of almost 3,700 MW. The installed performance is to rise up to 25 GW by the end of 2020.

Political framework

Power production from offshore wind energy in the UK is paid using flow rate control according to which the power suppliers must fulfil a certain regular quota of renewable energy to the power production. They can demonstrate these by purchasing so-called Renewable Obligation Certificates (ROCs). The power suppliers can purchase the certificates from the operators of the offshore wind farms, who receive a certain number of ROCs per megawatt hour (MWh) produced. The number of certificates issued per MWh is adjusted at regular intervals on the basis of advances in offshore development. The operators of offshore wind farms receive the certificates for a maximum period of 20 years.

Denmark

Implementation status

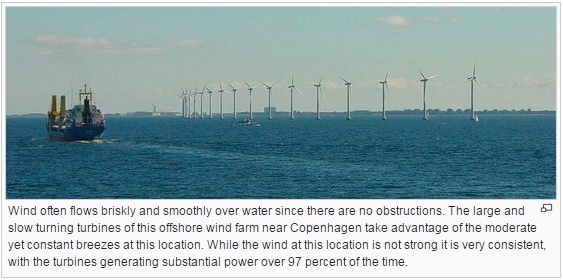

With its long coastline along the North and Baltic Sea Denmark also is a forerunner in the use of offshore wind energy. At the end of 2013, a total of approximately 416 offshore wind energy plants were connected to the grid with a total capacity of about 1,270 MW. Denmark wants to increase the capacity to approximately 4.6 GW.

Political framework

Development of offshore wind energy can take place in two ways. On the one hand, projects are tendered by the government with size and location, whereby the bidder offering the lowest feed-in remuneration per kilowatt hour will be granted the contract. A quantity of power of up to 10 terawatt hours is then paid at this price for a maximum of 20 years. On the other hand, developers can realise their own products for which they receive a fixed feed-in remuneration for each kilowatt hour produced plus the market revenue. This is also granted for a period of 20 years.

The Netherlands

Implementation status

At the end of 2013, the Netherlands had an installed offshore performance of 250 MW. The country aims to achieve an offshore capacity of 6 GW by 2020. The first remuneration system which was also used to construct offshore wind farms was completed in 2006 so that only previously approved wind parks have been realised since then. No capacity was added between 2009 and 2013.

Political framework

A subsequent programme was started in 2008 in order to achieve the development objectives of the government which has also been valid for the offshore sector since 2010. The operators of offshore wind farms are paid in accordance with a basic remuneration from which a correction figure is deducted on the basis of the market price. The remuneration is granted for a period of 15 years.

Belgium

Implementation status

Just like the Netherlands their neighbour Belgium also owns areas of the North Sea that can be used for the construction of offshore wind farms. At the end of 2013, offshore wind energy plants with a capacity of approximately 570 MW were in operation in Belgium. The aim is to increase capacity up to 2.1 GW by 2020.

Political framework

In order to accelerate development, Belgium uses a quota system with certificates for which minimum and maximum prices are determined. The power suppliers undertake to submit a certain number of certificates from renewable energy in the relevant regions and must purchase these from the plant operators. The minimum price for the certificates from offshore wind energy at the end of 2012 was 107 €/MWh for project capacity up to 216 MW, for larger projects it was 90 €/MWh.

Sweden

Implementation status

Sweden has the potential to construct offshore wind farms, primarily on its east coast. Offshore capacities with a total performance of over 210 MW were connected to the grid at the end of 2013. The country aims to produce up to 10 TWh per annum of power from offshore wind energy from 2020 onwards.

Political framework

Sweden is primarily using a quota model with combined certificate trading in order to support development. Operators of offshore wind farms receive a certain number of certificates per produced megawatt hour of power, which they can then sell to the energy suppliers. There are further support payments for the construction of offshore wind energy plants , e.g., via tax relief.

Finland

Implemention status

Just like Sweden Finland also has offshore potential along its Baltic Sea coast. At the end of 2013 Finland was operating nine offshore wind energy plants with a total capacity of approximately 26 MW. There are currently no plans to further develop these capacities.

Political framework

Finland uses both direct state support and a so-called premium tariff for the feed-in of regenerative power to provide support for offshore technology. In this way, it is possible to compensate up to 40 percent of the additional costs in comparison to conventional power stations when using offshore wind farms. The operators of offshore wind farms also receive a premium tariff in addition to the market price realised for the feed power for a period of up to 12 years to thus guarantee a target price for power from offshore wind energy. Furthermore Finland has a premium tariff for wind energy projects until 31.12.2015.

Ireland

Implementation status

Ireland has great potential for the construction of offshore wind farms because of its island location. Corresponding projects can be realised in both the Irish Sea and the Atlantic Ocean. The current level of offshore wind energy use is rather low with an installed performance of approximately 25 MW in 2013.

Political framework

Power production from renewable energy has been supported with feed-in remuneration in Ireland since 2006. This system was expanded in 2009 to include offshore wind energy plants. The power supplier benefits from the feed-in remuneration of 14 cents per kilowatt hour (ct/kWh). The supplier is then free to negotiate a price for the offshore power with the operator of the wind energy plants. Thanks to the remuneration this can be up to 14 ct/kWh higher than the current market price. The feed-in remuneration is paid for a period of 15 years.

France

Implementation status

No offshore wind power plants have yet been realised in France. Potential exists in the Mediterranean Sea, the Atlantic and the English Channel. Offshore wind energy is currently being introduced and the aim is to install up to 6 GW by 2020. The government is putting offshore projects to tender for this purpose so that interested developers can submit applications.

Political framework

Development is to be accelerated primarily using feed-in remuneration. The remuneration for offshore wind power plants is currently set at 20 years. The rates of remuneration vary depending on the location of the offshore plants. The winners of government tendered projects can receive a special feed-in remuneration in addition to the feed-in remuneration for their own projects.

The Rest of Europe

Besides the states named above, most of which have already realised offshore projects, other European countries are also introducing offshore wind energy. Both Spain, which is planning capacity development of up to 3 GW, and its neighbour Portugal are considering this topic with Portugal having already constructed a test plant with a performance of 2 MW and Spain having installed one project with 5 MW. In the Baltic Sea area Poland, Estonia, Lithuania and Latvia are working together on the development potential of offshore wind energy. Another pilot plant has also been constructed off the coast of Norway. Other countries such as Italy, Greece, Bulgaria etc. have access to the sea and thus possible potential for offshore markets in the long term.

International wind farms - Rest of the World

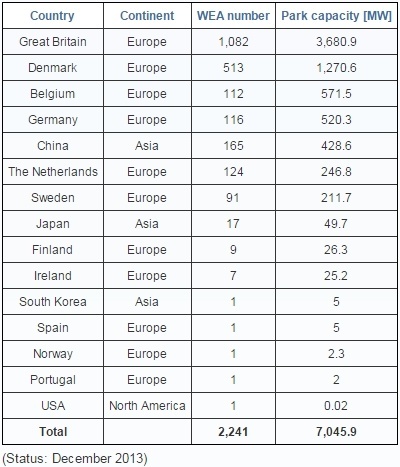

On an international level, offshore wind farms (OWP) already operate in several countries. The information originates from the respective operators of the individual OWP’s. Great Britain is the leading force with a total offshore capacity of almost 3,700 MW (as at the end of 2013).

North America

USA

While the majority of global offshore capacity has so far been installed in Europe, the USA has to date completely renounced this type of energy production. The government has declared the objective of installing up to 10 GW of offshore capacity by 2020 and realising multiples of this quantity by 2030. In particular projects are already being discussed off the east coast. Direct technology support and the boosting of certain projects aim to support development. The model for these ambitious objectives is offshore development in Europe.

Canada

As for its neighbour, the USA, no offshore capacity has yet been installed in Canada. In general, the country can look to both the Atlantic and Pacific coasts for potential with most existing plans for projects on Lake Ontario. This is possible because the province of Ontario supports the development of offshore wind energy with feed-in tariffs. There is no overall government strategy for the development of offshore wind energy in Canada, because the responsibility for energy policy and thus also for renewable energies lies with the provincial regions. There is therefore also no general development objective for offshore wind energy.

Block Island Wind Farm - USA

Asia

China

China is one of the few countries outside Europe that has already realised initial offshore wind farms (OWP). Potential for offshore wind energy plants (Offshore-WTG) exists in the China Sea, which includes the East and South China Sea and the Yellow Sea. Overall, Offschore-WTG with a total capacity of approximately 430 MW had been installed by the end of 2013. Beyond this there are numerous other projects in development. The installation of further capacity of up to 5 GW is planned by 2015, mainly on the east coast. The capacity is to rise up to 30 GW by 2020. The government tenders each project and grants the winners of the tender process a feed-in remuneration for the regenerative power produced. The largest tendered wind park currently has a capacity of approximately 2 GW.

Japan

As well as China, Japan has also already installed offshore capacity. At the end of 2012 offshore plants are producing regenerative power with a capacity of 50 MW. Japan has great offshore potential because of its island location, particularly on the Pacific coast and the coast onto the Sea of Japan. After the reactor disaster at the Fukushima nuclear power plant the government wishes offshore wind energy to reduce the country's dependency on nuclear power. This is why further pilot projects are currently being planned and tenders have already been announced for several large projects. Japan supports offshore technology by granting feed-in remuneration, while no development objective has yet been determined.

Rest of Asia

Other Asian countries also expect offshore energy to play an important role in the future. For example South Korea plans to install the world's largest offshore wind park with a capacity of 2.5 GW by 2019. India is also in the process of reviewing the potential of offshore wind energy and will then realise concrete projects. Taiwan is currently working on the planning and realisation of offshore pilot projects and then plans to give massive support to the development of offshore wind energy. Until 2020 about 600 MW are planned for installation, for 2030 the set target is 3 GW.

To receive more information on this article, our Newsletter or find out more about what w3.windfair.net has to offer, please, do not hesitate to contact Trevor Sievert at ts@windfair.net.

Please don't forget to follow us on Twitter: w3.windfair.net on Twitter

w3.windfair.net is the largest international B2B internet platform in wind energy – ultimately designed for connecting wind energy enthusiasts and companies across the globe.

- Source:

- Online Editorial, w3.windfair.net

- Author:

- Trevor Sievert, Online Editorial Journalist / By AWEA Staff

- Email:

- ts@windfair.net

- Link:

- w3.windfair.net/...