News Release from American Clean Power Association (ACP)

Wind Industry Profile of

Editor's Choice - Missing the big picture on energy subsidies

The Energy Information Administration recently released a brief snapshot in time of the incentives for different energy sources. By itself, this snapshot paints an incomplete and distorted picture of the impact of incentives on our energy mix. Fossil fuels have benefited from permanent incentives for nearly a century, and nuclear for more than half a century, while tax incentives for less mature renewable energy technologies such as wind came only recently and have often been enacted for only short-term periods. In reality, cumulative incentives for wind and other renewable resources are a drop in the bucket compared to those for other energy sources.

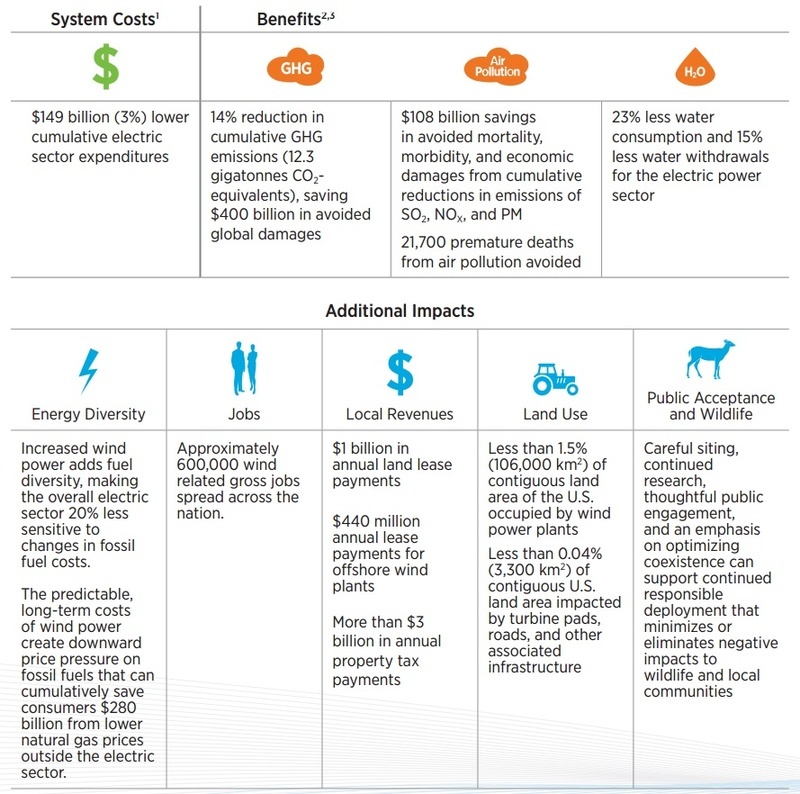

The nonpartisan Congressional Research Service explained “For more than half a century, federal energy tax policy focused almost exclusively on increasing domestic oil and gas reserves and production. There were no major tax incentives promoting renewable energy or energy efficiency.” Below, the Nuclear Energy Institute’s own tally finds that all renewables accounted for less than 10 percent of federal energy incentives over the period 1950-2010, versus 70 percent for fossil fuels.

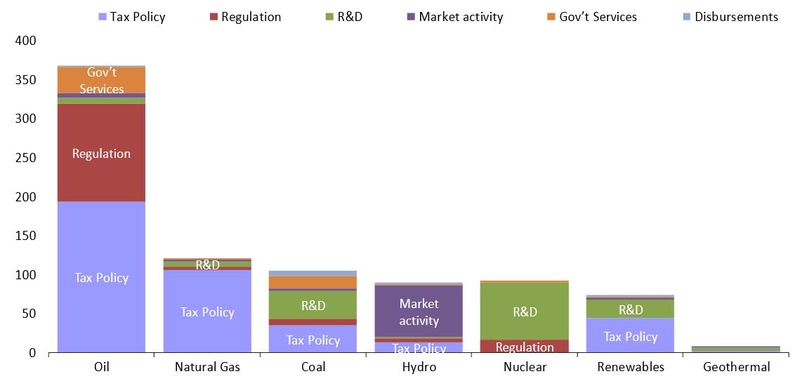

Finally, DBL Investors tallied the incentives given to fossil, nuclear, and renewables and the period over which those incentives have been paid. Based on the data in the chart below, the result is $447 billion for fossil and $185.5 billion for nuclear, versus less than $6 billion for renewables. Renewables therefore account for less than 1 percent of the total amount given to fossil and nuclear.

It is also important to note that fossil fuels have benefited from permanent tax incentives for nearly a century, which has given those energy sources the ability to make long-term business plans based on these policies. The Energy Information Administration (EIA) data do not account for the uncertainty that renewable energy businesses have had to face as a result of temporary incentives that are extended for only short periods of time.

EIA’s recent tallyis also missing several important incentives for other energy sources, such as the Foreign Tax Credit. The fossil fuel industry has had access to this tax credit since the 1950s, though it is consistently under-counted and not well understood. In the 1950s, foreign governments in oil-producing states began reclassifying royalty payments as income taxes. Unlike royalty payments, foreign income tax payments are eligible for a dollar-for-dollar tax credit, rather than a deduction (worth $0.35 per dollar). The subsidy amount is equal to additional value conferred by the credit over the value that a business expense deduction would provide. This improper classification of royalties as foreign income taxes is rarely, if ever, counted in subsidy analyses, but it costs billions in taxpayer dollars each year. The EIA analysis and many of the above analyses also did not account for the Price-Anderson Act, which limits the nuclear industry’s liability for accidents.

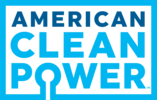

Finally, the EIA analysis ignores the benefits of supporting less mature technologies and technologies that provide environmental, public health, and energy security benefits. The renewable Production Tax Credit helps correct for flaws in our electricity market design that do not value wind’s benefits for protecting public health, the environment, and consumers. Wind energy creates billions of dollars in economic value by drastically reducing pollution that harms public health and the environment, but wind energy does not get paid for that even though consumers bear many of those costs. Wind energy also protects consumers from price increases for fuel, but that is not accounted for in the highly regulated electricity market because other energy sources get to pass their fuel price increases directly on to consumers who have little choice in the matter.

The primary purpose of incentives is to encourage investment in technologies that have public benefits. Wind energy, as a clean technology that helps diversify our energy mix, has many public benefits worth incentivizing.

The wind industry continues to make tremendous technological progress that has reduced costs by more than half over the last five years, even with uncertain policies. Costs have come down as the U.S. wind industry has scaled up to 50,000 workers and 500 manufacturing facilities in 43 states. Stable policy incentives for clean, affordable energy will ensure the wind industry can continue reducing costs so that more Americans can benefit from wind energy.

To receive more information on this article, our Newsletter or find out more about what w3.windfair.net has to offer, please, do not hesitate to contact Trevor Sievert at ts@windfair.net.

Please don't forget to follow us on Twitter: w3.windfair.net on Twitter

w3.windfair.net is the largest international B2B internet platform in wind energy – ultimately designed for connecting wind energy enthusiasts and companies across the globe.

- Source:

- American Wind Energy Association

- Author:

- Trevor Sievert, Online Editorial Journalist / By AWEA Staff / Shauna Theel

- Email:

- windmail@awea.org

- Link:

- www.awea.org/...