News Release from WindEurope

Wind Industry Profile of

Investors want to finance more wind energy – Governments need to back this

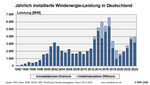

Investments in wind energy keep rising. Last year Europe invested €41bn in new wind farms. This translated into the highest capacity of new wind farms ever financed in one year – 25 GW. However, this is still not enough to deliver Europe’s energy security and climate targets. With REPowerEU the EU now wants to expand wind energy from 190 GW today to 510 GW by 2030. This means 39 GW of new wind farms every year.

Wind energy has a good track record when it comes to financing. It’s seen as an attractive investment, and there is plenty of capital available. If a project is good it will attract the necessary finance. However, there currently are not enough projects to invest in. The main bottleneck here is slow and cumbersome permitting procedures.

To create optimal financing conditions for wind energy national Governments and the European Commission must create stable and transparent regulatory frameworks. Retroactive changes in support schemes and the introduction of clawback measures can destroy investor confidence. And negative bidding in auctions adds unnecessary costs that have to be passed on to the supply chain or the end consumer and reducesh the competitiveness of wind energy. These kinds of measures erode financial security and will make Europe’s energy transition more expensive.

In offshore wind we have also seen policies which undermine investment security such as the uncapped seabed leasing for offshore wind in the UK. Governments should consider the potential implications of such designs carefully as ultimately they will lead to an increase in the long-term cost of Europe’s energy transition.

On an EU level there are factors that can contribute to more efficient financing of renewable energy. Currently the European Commission is not offering enough innovation funding to wind energy. And not enough investments from the Recovery & Resilience Fund are going to new renewables capacity.

WindEurope CEO Giles Dickson said: “The European Commission wants Europe to build much more wind energy and investors are willing to put the necessary capital. But Governments need to facilitate this and ensure they don’t discourage investments by introducing policies which deter investment. Retroactive changes such as the clawback measures introduced by multiple Governments and negative bidding in auctions drive investors away from investing in wind and make the energy transition more expensive. Governments should clear the way for sustainable investments in wind energy”

- Source:

- WindEurope

- Author:

- Press Office

- Link:

- windeurope.org/...

- Keywords:

- WindEurope, investors, government, EU Commission, market, sustainablity, GW, financing, project, energy transition