News Release from American Clean Power Association (ACP)

Wind Industry Profile of

AWEA - Kiernan calls on Government to extend PTC and ITC Tax Credits

As Congress considers extensions of tax policies used by a variety of businesses, it is crucial that the renewable energy Production Tax Credit (PTC) and Investment Tax Credit (ITC) be extended at least through 2015 as included in the EXPIRE Act, passed unanimously on a bipartisan basis by the Senate Finance Committee in April.

“We call on all clean energy supporters in Congress and the White House to work to pass a two-year extension of these critical tax policies,” said Tom Kiernan, CEO of the American Wind Energy Association (AWEA). “The three-week extension being considered by the House does not provide the certainty and stability needed to keep U.S. factories open and keep workers on the job. And if you think otherwise, try telling that to the American workers who will be laid off starting in January.”

“A three-week extension kills jobs and provides businesses little ability to create the jobs we want to create,” said Kiernan.

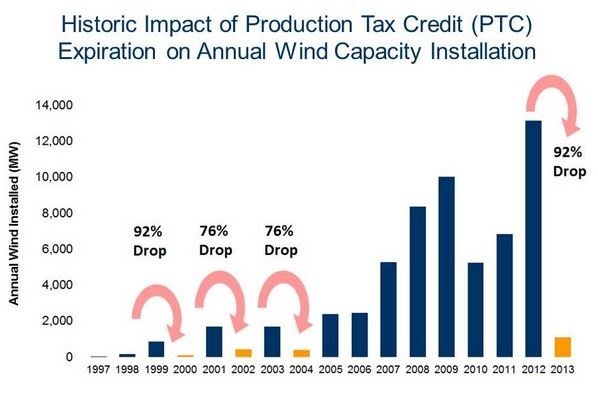

When the PTC expired in 2013, new wind installations came to a halt, resulting in a 92 percent drop in new wind projects compared to 2012 and a $23 billion drop in private investment in the U.S. economy. Nearly 30,000 American jobs were lost. Similar job losses would be expected to occur unless an extension through at least 2015 is passed.

“A multi-year PTC phase-out was reportedly discussed last week. A phase-out of sufficient length and design that provides an appropriate glide path is something that could also work for the wind industry. AWEA welcomes analyzing any proposal that is long-term and fair,” Kiernan said.

The PTC has allowed the wind industry to compete with other energy sources that have been subsidized for decades, driving private investment, domestic manufacturing and rural economic development for the U.S. Wind energy now provides over 4 percent of U.S. electricity, powering over 18 million homes nationwide.

For many rural areas, wind has delivered needed economic development – landowners including many family farmers and ranchers now receive about $180 million in annual lease payments for hosting wind farms.

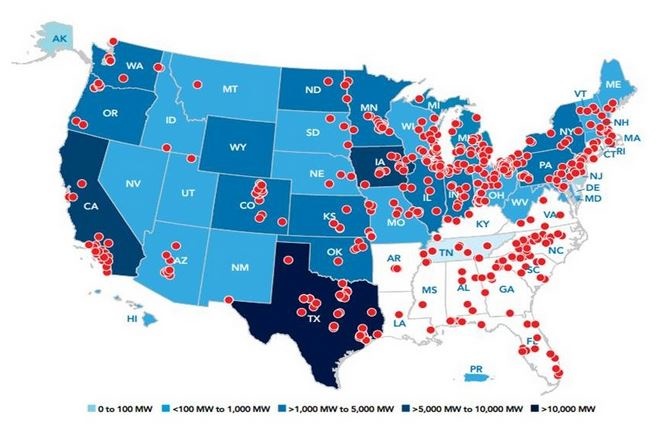

Today, over 500 factories across 43 states manufacture for the wind energy industry. These factories provide well-paying jobs for American workers. Any disruption in the PTC now would increase the cost of future wind projects, and erase much of the progress in creating this new U.S. manufacturing sector.

Locations of the 550+ U.S. facilities that manufacture for the wind energy industry

A national poll released last week found 73 percent of American voters support continuing the Production Tax Credit, including a wide majority of Republicans.

The results showed unwavering support among registered voters since a poll conducted last December by USA Today, Stanford University, and Resources for the Future, which also found 73 percent support for the tax incentives that encourage private investment in clean energy.

If you like to receive our Newsletter or find out more about what w3.windfair.net has to offer, please, do not hesitate to contact Trevor Sievert at ts@windfair.net.

w3.windfair.net is the largest international B2B internet platform in wind energy – ultimately designed for connecting wind energy enthusiasts and companies across the globe.

- Source:

- American Wind Energy Association

- Author:

- Edited by Trevor Sievert, Online Editorial Journalist / by AWEA Staff

- Email:

- windmail@awea.org

- Link:

- www.aweablog.org/...