Keppel Corporation and Keppel Infrastructure Trust to jointly invest in German offshore wind farm

Keppel Corporation Limited (Keppel Corporation or together with its subsidiary, the Group) and Keppel Infrastructure Fund Management Pte Ltd (KIFM), the Trustee-Manager of Keppel Infrastructure Trust (KIT), are pleased to announce that they are jointly investing €305.0 million (approximately S$445.3 million) to acquire a 50.01% stake in a special purpose vehicle (SPV) that holds 50% of Borkum Riffgrund 2 (BKR2), an offshore wind farm in Germany. The SPV is currently wholly owned by Gulf International Holding Pte. Ltd., a subsidiary of Gulf Energy Development Public Company Limited (Gulf), one of Thailand’s largest private power producers. Post-acquisition, Gulf will retain a 49.99% stake in the SPV. Ørsted, the world’s leader in offshore wind power with over 30 years of experience in developing offshore wind farms, owns the remaining 50% stake in BKR2 (See Annex for transaction structure).

Fully operational since 2019, BKR2 has an operating capacity of approximately 465 MW and is located 59km off the coast of Lower Saxony in the North Sea, Germany, which is an area with high wind availability as reflected in the high average historical capacity factors of more than 40%. The region is next to the Wadden Sea, an UNESCO World Heritage site. Hence, it is unlikely for wind farms to be built at the Wadden Sea, mitigating potential reduction in wind availability to BKR2.

BKR2 operates under the German EEG 2014 market premium mechanism, which has an attractive Feed-in-Tariff and guaranteed floor price till 2038, providing strong cash flow visibility for the project. This arrangement de-risks the asset. The project also holds a 20-year power purchase agreement and a 20-year operations and maintenance agreement (OMA), until 2038, with Ørsted. The long-term OMA has a largely fixed operational cost base which provides significant cost certainty and cash flow visibility. As the 50% shareholder of BKR2, Ørsted will continue to operate BKR2 with a strong alignment of interest.

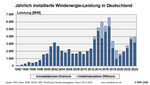

To meet its climate commitments, Germany has been rapidly growing its renewable energy market, and has committed to phasing out coal and nuclear power. In February this year, Germany brought forward its 100% renewables target by 15 years to 2035, and announced the country’s plan to triple the pace of capacity expansion for wind and solar. Against the backdrop of reduced reliance on coal and nuclear, coupled with increase in electricity demand due to decarbonisation and electrification of key sectors, the price outlook for renewable energy in Germany is expected to be favourable.

Following Keppel Corporation and KIT’s investment in onshore wind farm assets across Sweden and Norway announced on 13 July 2022, this transaction further accelerates the growth of the Group’s exposure in renewable energy assets and is underscores of the Group’s commitment towards Keppel’s Vision 2030. Upon the completion of this investment, the Group will have a total renewable energy portfolio of approximately 2.2 GW, including assets under development. The transaction will also contribute to KIT’s target of increasing exposure to renewable energy assets by up to 25% of equity-adjusted AUM by 2030, increasing KIT’s exposure from 4% to 11%.

Mr Loh Chin Hua, CEO of Keppel Corporation, said, “The demand for renewable energy is expected to intensify as the world journeys towards its net zero goal. We are pleased to strengthen our partnership with best-in-class partners such as Gulf and Ørsted through this transaction, and look forward to future collaboration opportunities. This transaction is aligned with Keppel’s Vision 2030, which see renewables, clean energy and decarbonisation solutions playing increasingly integral roles as we make sustainability our business. It also demonstrates how we can harness the Group’s eco-system and business networks to source for and capture opportunities to scale up in our focus areas and grow recurring income.”

Mr Jopy Chiang, CEO of KIFM, said, “This transaction marks KIT’s first investment in the offshore wind sector, and our second investment in the European renewable energy market, further reinforcing our strategy to grow our Energy Transition segment and almost tripling KIT’s renewable energy portfolio to over 700 MW. Underpinned by favourable tailwinds such as energy security, electrification and higher projected demand for green energy in the future, this investment underscores the global acceleration towards decarbonisation and net-zero. The Trust will continue to make inroads to capture more opportunities in the renewable energy sector, in support of our ESG target.”

The transaction is expected to be completed in the fourth quarter of 2022. KIFM intends to fund the investment with an optimal combination of internal sources of funds, equity and/or debt capital market issuances and/or external borrowings. Keppel Corporation, through its wholly owned subsidiary, KRI, will also fund its share of the investment by way of capital contributions to the joint venture. Upon completion of the transaction, KIT’s assets under management will grow from S$4.7 billion as at 30 June 2022 to approximately S$5.0 billion. Including the investment in the onshore wind assets in Sweden and Norway announced on 13 July 2022, as well as the investment in Eco Management Korea announced on 8 August 2022, KIT's assets under management will grow to approximately S$6.1 billion.

This transaction is expected to support KIT’s overall distributable income per unit accretion. The above development is not expected to have any material impact on the net tangible assets per share or earnings per share of Keppel Corporation for the current financial year.

- Source:

- Keppel

- Author:

- Press Office

- Link:

- www.kepcorp.com/...

- Keywords:

- Keppel, Germany, investment, offshore, wind farm, Trsut, energy transition, MW, Borkum Riffgrund 2