News Release from Prysmian

Wind Industry Profile of

Results for the First Half of 2020

The Board of Directors of Prysmian S.p.A. has approved today the Group’s consolidated results for the first half of 2020.

- Sales at €4,985M (-11.8% organic change). As expected, the Covid-19 crisis mainly impacted the Trade & Installers business (-16.3%) linked to the construction sector, after a strong start. The Power Distribution showed greater resilience. Solid performance of Energy & Infrastructure in North America (+0.9%) mainly thanks to Onshore Wind. The Industrial and Network Components business remained stable, with negative impacts reported above all by Automotive (-1.1% organic change, excluding the Automotive segment). The Telecom segment declined, in line with expectations (-20.1%) as a result of the comparison with the excellent H1 2019 performance and the effects of the pandemic, which further slowed down installation activities.

- ADJUSTED EBITDA at €419M (€521M in H1 2019). Stable margins, with ratio of Adjusted EBITDA to Sales at 8.4% (8.9% in H1 2019). Improved profitability in the Energy segment, whereas the Projects segment was penalised by delays in project progress also caused by the pandemic. Telecom results in line with expectations, impacted by lower volumes and price pressure, partly offset by the cost containment measures. The contribution of the Chinese affiliate YOFC also declined.

- Solid financial structure. Net Financial Debt improved to €2,516 million (€2,819 million at 30 June 2019) thanks to the strong cash generation: LTM Free Cash Flow at €519 million, up compared to €433 million at 31 December 2019.

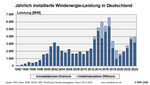

“The results of the first half of the year are characterised by the essential stability of the business and the further reinforcement of financial solidity, with debt declining thanks to increased cash flows, and demonstrate the Group’s resilience,” stated Chief Executive Officer Valerio Battista. “The responsiveness and flexibility of our supply chain, paired with the high level of differentiation of the markets in which we operate, have enabled us to respond forcefully to the effects of the Covid-19 pandemic. The Energy business held up even better than expected, while longer-term drivers such as the energy transition and digitalisation remained unchanged. With the pandemic in full force, we secured about 50% of the German Corridors, bringing the order backlog to the record level of over €3.8 billion. The market for optical cables continues to be weak, but we are poised to take advantage of the recovery, thanks to the efficiencies achieved, which have increased our competitiveness, and to the robust pipeline of technological innovation we have developed. Finally, as shown by the acquisition of EHC in the vertical mobility sector, we also possess adequate resources to grasp opportunities to accelerate our presence in high added value markets”.

Covid-19: about €100 million cost efficiencies expected for the full year

The plan of extraordinary measures implemented at the outset of the Covid-19 pandemic is proving effective and capable of meeting the objectives of safeguarding employee and individual health, ensuring continuity of operation and the supply chain, and protecting profitability and cash flows. The rigid health and hygiene standards adopted in our plants and offices are another factor that has helped contain the impact of the pandemic on our people. Our IT infrastructure and new organisation of work are ensuring productivity and continuity, including through extensive use of remote working. The supply chain has proved responsive and flexible, permitting high levels of operation and response to the needs of the clients. Finally, the measures to protect profitability and the solidity of the financial structure have proved effective. Cost efficiencies at the annual level expected to amount to about €100 million.

To read the full press release, please visit the website of Prysmian Group.

- Source:

- Prysmian Group

- Author:

- Press Office

- Link:

- www.prysmiangroup.com/...

- Keywords:

- Prysmian Group, results, half, 2020, sales, ratio, EBITDA, Germany, cables, order, transmission, grid, link