News Release from PNE AG

Wind Industry Profile of

PNE AG: 2019 fiscal year closed very successfully

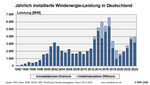

PNE AG closed the year 2019 very successfully in operational terms. This is the result of the annual report published today. With 450.8 megawatts (MW) of projects sold, commissioned or under construction, the previous year's level (235.7 MW) was exceeded significantly. Based on an assumed average investment volume of around euro 1.4 to 1.8 million per MW of installed nominal capacity, PNE has initiated investments of around euro 631 to 811 million in 2019 (prior year: euro 330 to 424 million).

In the 2019 fiscal year, the PNE Group generated earnings before interest, taxes, depreciation and amortisation (EBITDA) of approx. euro 31.6 million and operating profit (EBIT) of approx. euro 19.0 million. This means that the upper end of the guidance for EBITDA of euro 25 to 30 million and for EBIT of euro 15 to 20 million was achieved in the 2019 fiscal year. The earnings per share amounted to euro 0.01. The equity ratio was 38.8 percent as at December 31, 2019. The available liquidity remains high: At the end of 2019, the Group had liquidity from cash and cash equivalents totalling euro 111.9 million.

CEO Markus Lesser: "2019 was a good year for the PNE Group, which we concluded with a very good result. Operationally, we have been successful in various markets including Sweden and Poland. Strategically, we have consistently developed further in line with the "Scale up" concept."

Profitable despite increased investing activities

The PNE Group has operated profitably in 2019, although investments were also made in the construction of its own wind power turbines. Due to the completion of wind farms and the acquisition of a project, the nominal capacity of the wind farms operated by the Company itself increased from 76.9 MW to 130.1 MW. The Company also incurred upfront expenditure in the context of implementing the "Scale up" concept. All business divisions contributed to the good result: national and international project development, electricity generation, operations management and the new service products.

Dividend proposed

The Board of Management and the Supervisory Board propose to pay a dividend of euro 0.04 from PNE AG's retained earnings totalling euro 111,559,172.29 per eligible no-par value share for the 2019 fiscal year. The remaining retained earnings shall be brought forward to a new account.

Project pipeline expanded further

At the end of 2019, the companies of the PNE Group were working on onshore wind farm projects with a nominal capacity to be installed of 5,235 MW (prior year: 4,883 MW), which are in different phases of the multi-year development process. This "project pipeline" is the basis for the further development of PNE.

There has also been progress in the development of photovoltaic (PV) projects. In this area, a pipeline with PV projects in Germany, Romania and the USA totalling 123 MWp can be reported for the first time at the end of 2019.

Expansion of the service business

The Company has further expanded its expertise in services relating to wind power turbines. With the acquisition of various companies in the fields of safety technology for wind turbines and industrial plants, aviation obstruction markers for wind turbines and rope access technology, the PNE Group has positioned itself much more broadly in the market.

By concluding the first contracts for operations management of wind farms in France, Poland and Sweden, the PNE Group succeeded in opening up additional markets and significantly expanding its international business in 2019. In total, PNE currently manages wind farms with a nominal capacity of more than 1,600 MW as operations manager.

Positive outlook to the year 2020

PNE is well positioned for its further development. And the course for the coming years is clear: investments in the Company's own portfolio are to be increased. The goal is to transfer up to 500 MW into PNE's own operations by the end of 2023. In addition, PNE will strengthen its core business and, at the same time, consistently push ahead with the expansion in the fields of services, technologies and markets.

CEO Markus Lesser: Despite our investments in building up our own portfolio, we are expecting positive EBITDA of euro 15 to 20 million and EBIT of euro 5 to 10 million for the Group's defined guidance for the 2020 fiscal year."

Although there is justified optimism, PNE sees possible consequences for society and the market resulting from the spread of the COVID-19 virus. PNE responds to this threat with a large number of measures to protect employees, but also to safeguard the implementation of projects as well as supplies.

Markus Lesser: “At present, we assume that there may be shifts in our operating business as regards the sale of project rights and project implementation from 2020 to 2021 and from 2021 to 2022 due to the current developments concerning the spread of the COVID-19 virus. This has already been taken into account in the guidance. At this point in time, we assume that there should be no significant impact on our business in the medium to long term. The good liquidity position gives the Company sufficient leeway to be able to cope well with longer-term restrictions."

- Source:

- PNE AG

- Author:

- Press Office

- Link:

- www.pne-ag.com/...

- Keywords:

- PNE AG, outlook, operating performance, growth, investment, market, service, developer, guidance, COVID-19, operation, fiscal year