Macquarie-led consortium to acquire the Green Investment Bank

A Macquarie-led consortium, comprising Macquarie Group Limited (Macquarie), Macquarie European Infrastructure Fund 5 (MEIF5) and Universities Superannuation Scheme (USS), has agreed to acquire the UK Green Investment Bank plc (Green Investment Bank) from HM Government for £2.3 billion.

Upon completion, Macquarie will be the owner of the Green Investment Bank with ‘special share’ arrangements to safeguard its green purpose which will be held by five independent trustees.

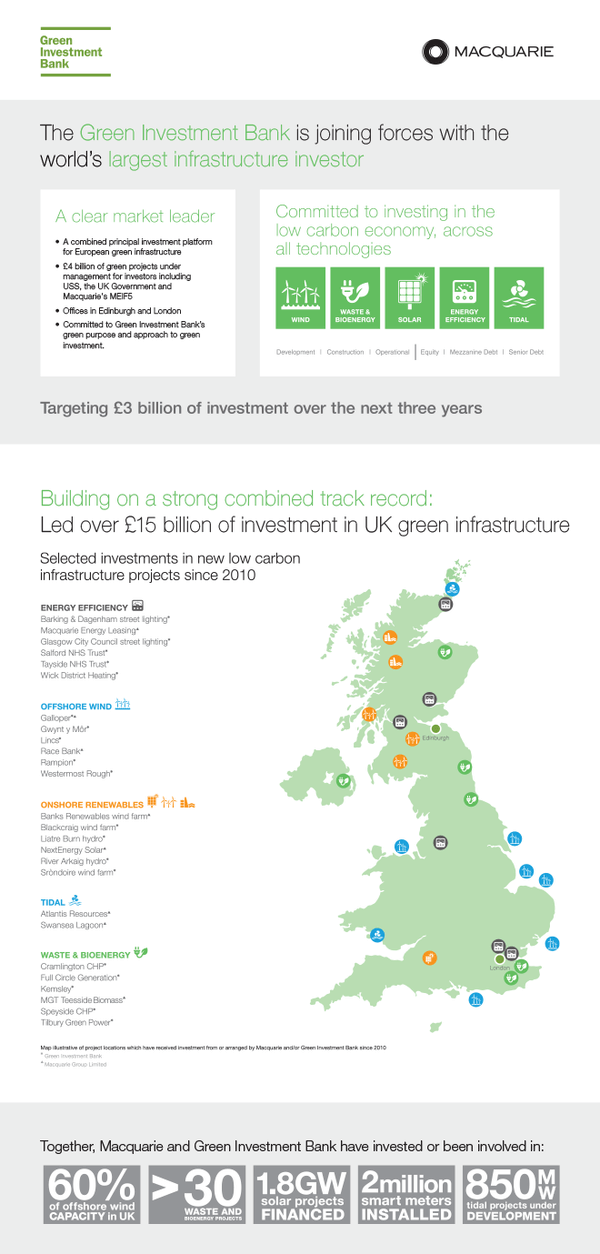

Upon transaction completion, the Green Investment Bank will manage or supervise over £4 billion of green infrastructure assets and projects, with investors including MEIF5, USS, GCP Infrastructure and the UK Government. Specifically, the Green Investment Bank will establish three new investment vehicles – an offshore wind investment vehicle, a low carbon lending platform and a green infrastructure investment platform.

Daniel Wong, Head of Macquarie Capital, Europe, said: “It is a privilege to be selected by HM Government to acquire the Green Investment Bank. The Green Investment Bank is a pioneering business, with outstanding people, expertise, credentials, brand and networks. By combining the Green Investment Bank with the largest infrastructure investor in the world, we will create a market leading platform dedicated to investment in the low carbon economy in the UK and beyond. We understand the responsibilities that come with this ownership, and we are fully committed to maintaining its green purpose as we grow the business.”

A growing commitment to the UK’s low carbon economy

The Green Investment Bank will become Macquarie’s platform for principal investments in green infrastructure projects in the UK and Europe. As a substantial investor in the UK’s renewable energy sector in its own right, Macquarie will integrate its existing UK green energy principal investing business into the Green Investment Bank.

The Green Investment Bank platform, brand and Edinburgh office will be maintained with a substantial staff presence in the city. The business will be led by senior Green Investment Bank executives, supported by key existing functions.

Macquarie is committed to the Green Investment Bank’s newly established target of £3 billion of new investment in green energy projects over the next three years, either directly or by arranging capital from other investors. Subject to the availability of suitable opportunities, anticipated investments will span energy efficiency, bioenergy, energy from waste, onshore and offshore wind, solar and tidal energy and energy storage. The Green Investment Bank will target investments in both equity and debt and at all project stages including development, construction and operation.

Under Macquarie’s custodianship, the Green Investment Bank will operate in accordance with its green purpose and green objectives and in line with the ‘special share’ arrangements. This will include publishing an annual report on its green performance, holding an annual industry day for stakeholders and green reporting.

Together, the Green Investment Bank and Macquarie will employ one of Europe’s largest teams of green energy investment specialists, based in Edinburgh and London. A new revenue-generating project delivery team in Edinburgh will provide critical technical, risk, project management and advisory services to green infrastructure investments managed by the Green Investment Bank and Macquarie.

Building on the Green Investment Bank and Macquarie’s track record

The Green Investment Bank will build on an unrivalled track record of investing in UK green infrastructure. Together, the Green Investment Bank and Macquarie have led a combined £15 billion of investment in the UK low carbon economy during the past five years. This includes investments in projects representing more than 60 per cent of the UK’s offshore wind generation capacity, 50 waste and bioenergy projects, and 1.8GW of solar projects. Macquarie is currently also advising on 850MW of tidal projects under development.

Macquarie’s UK green infrastructure investments include building the world’s largest bioenergy plant in Teesside, Race Bank, one of the UK’s largest offshore wind farms, installing over 2 million smart meters in UK homes, and retrofitting energy efficient street lighting in Nottingham and Tay Valley. More broadly, Macquarie has led over £35 billion of investment in UK infrastructure, including the National Grid gas distribution networks, the Mersey Gateway Bridge and the Edinburgh Hospital for Sick Children.

HM Government continuing to support the Green Investment Bank

The Green Investment Bank will continue the collaboration between UK Climate Investments (UKCI) and the Department of Business, Energy and Industrial Strategy. Macquarie is committed to UKCI and its vision to invest internationally.

Further, the UK Government will invest alongside the Green Investment Bank in a new green infrastructure investment platform which will comprise a small number of the Green Investment Bank’s existing investments.

Promoting green energy investment through the introduction of new investors

Of the three new investment vehicles to be established upon completion, long term infrastructure investors USS and MEIF5 will invest in the offshore wind investment vehicle, and USS and GCP Infrastructure Investments will invest in the low carbon lending platform. The Green Investment Bank will remain an investor in the offshore wind investment vehicle and the green infrastructure investment platform.

The introduction of these investors brings new private capital from day one and enables the Green Investment Bank to recycle capital into new projects while growing assets under management.

Martin Stanley, Global Head of Macquarie Infrastructure and Real Assets (MIRA), said: “The opportunity to deploy capital from MEIF5 into the Green Investment Bank’s offshore wind platform provides the fund with an attractive investment in a diverse portfolio of offshore wind assets in the UK. This acquisition will provide the investors in our fund, which include UK and international pension funds and institutions, with long-term exposure to well-managed businesses in well-regulated and established markets.”

Mike Powell, Head of Private Markets at USS, said: "This transaction has enabled USS to acquire a portfolio of high quality renewable energy assets on behalf of our members. The assets include offshore wind projects and a portfolio of renewable loans, illustrating our capability to invest across the capital structure. We look forward to continuing our relationship with the Green Investment Bank and finding new opportunities to invest in the low carbon economy in the UK."

Mr Wong said: “The future for green investment is very positive globally and the Green Investment Bank, combined with the Macquarie platform, will be well positioned to source opportunities and deploy capital. This acquisition is underscored by Macquarie’s decades-long commitment to the UK as an attractive place to invest, and is a clear continuation of Macquarie’s pioneering role in the infrastructure sector and our commitment to the low carbon economy.”

The transaction is expected to complete in the first half of 2017 subject to regulatory approvals and is not material to Macquarie Group’s earnings and financial position.

- Source:

- Macquarie

- Author:

- Press Office

- Link:

- www.macquarie.com/...

- Keywords:

- GIB, UK, aquisition, Macquarie, investment