News Release from Wood Mackenzie Ltd

Wind Industry Profile of

Decisive action needed to achieve net zero by 2050, as world is currently on path for 2.5 °C to 3 °C global warming, according to Wood Mackenzie

Decisive action needed to achieve net zero by 2050, as world is currently on path for 2.5 °C to 3 °C global warming, according to Wood Mackenzie Analysis shows US$78 trillion needed to achieve net zero and 1.5 C warming scenario

LONDON and HOUSTON and SINGAPORE, Oct. 29, 2024 (GLOBE NEWSWIRE) -- A string of global shocks has likely put 2030 emissions reduction targets out of reach. But with decisive action, there is still time to reach net zero emissions by 2050, according to Wood Mackenzie’s ‘Energy Transition Outlook’ report, a milestone assessment of the global journey towards a lower carbon future.

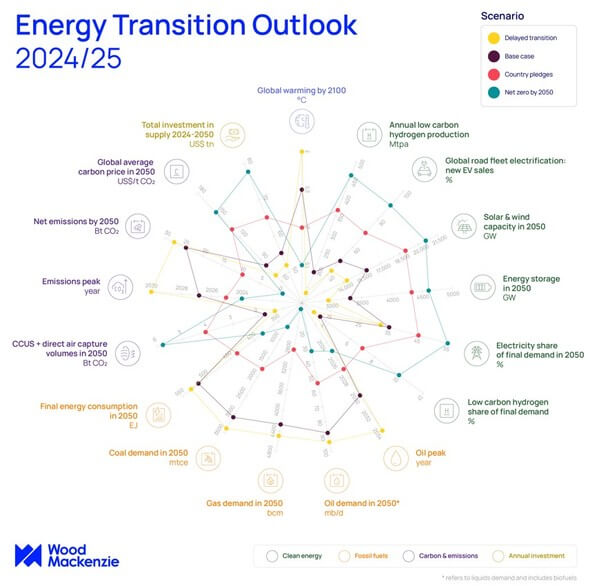

The new report analyses four different pathways for the energy and natural resources sector – Wood Mackenzie’s base case (2.5-degrees), country pledges scenario (2-degrees), net zero 2050 scenario (1.5-degrees) and delayed transition scenario (3-degrees).*

KEY FINDINGS:

US$78 trillion of cumulative investment required across power supply, grid infrastructure, critical minerals and emerging technologies and upstream to meet Paris Agreement goals.Globally, energy demand is growing strongly due to rising incomes, population and the emergence of new sources of demand, including data centres and transport electrification.Strong renewables growth is a certainty and this will continue under all scenarios modelled in this update. Renewables capacity grows two-fold by 2030 in the base case, short of the global pledge made at COP28 to triple renewables by 2030.Oil and gas are projected to continue playing a role in the global energy system to 2050.Innovation will improve the commerciality of carbon capture and low-carbon hydrogen and derivatives, driving uptake to 6 Btpa and 0.45 Btpa by 2050.Policy certainty crucial to helping unlock demand for new technologies and increases capital flow into all segments, including supply chains and critical minerals.

“A string of shocks to global markets threaten to derail the progress in a decade pivotal to the energy transition. From the unresolved war between Russia and Ukraine to an escalated conflict in the Middle East, as well as rising populism in Europe and global trade tensions with China, the energy transition is in a precarious place and 2030 emissions reduction targets are slipping out of hand,” said Prakash Sharma, vice president, head of scenarios and technologies for Wood Mackenzie. “However, there is still time for the world to reach net zero emissions by 2050 – provided decisive action is taken now. Failure to do so risks putting even a 2 °C goal out of reach, potentially increasing warming to 2.5 °C – 3 °C trajectory.

“We are under no illusion as to how challenging the net zero transition will be, given the fact that fossil fuels are widely available, cost-competitive and deeply embedded in today’s complex energy system,” added Sharma. “A price on carbon maybe the most effective way to drive emissions reduction but it’s hard to see it coming together in a polarised environment. We believe that these challenges are overcome with policy certainty and global cooperation to double annual investments in energy supply to US$3.5 trillion by 2050 in our net zero scenario.”

Electrification is the accelerated route to energy efficiency and peak emissions

The electrification of the energy system is the central plank of the energy transition. In Wood Mackenzie’s base case, displacing fossil fuels with more energy-efficient electricity leads to global emissions peaking in 2027 and subsequently falling by 35% through to 2050.

Global final energy demand is projected to grow by up to 14% by 2050. For emerging economies with rising populations and prosperity, growth is 45%, whereas demand in developed economies peaks in the early 2030s and enters a decline. The reshoring of manufacturing (supply chains, cleantech, semi-conductor chips), green hydrogen and electric vehicles support demand growth, particularly in the US and Europe. Artificial intelligence and the build-out of data centres are new growth sectors, increasing electricity consumption from 500 TWh in 2023 to up to 4,500 TWh by 2050.

“While electrification is at the heart of energy security, the quick expansion of electricity supply is often constrained by transmission infrastructure which takes time to permit and build,” said Sharma. “Recognising these challenges, we modelled different electrification rates in our energy modelling. Electricity’s share of final energy demand steadily rises from 23% today to 35% by 2050 in our base case. And, in an accelerated transition such as our net zero scenario, the share of electricity increases to 55% by 2050.”

The relentless rise of renewables has implications for gas

The share of solar and wind in global power supply increased from 4.5% in 2015 to 17% in 2024.

Strong renewables growth is a certainty in the energy transition, and this will continue under all scenarios modelled in this update. Renewables capacity grows two-fold by 2030 in the base case, short of the global pledge made at COP28 to triple renewables by 2030.

Solar is the biggest contributor of renewable electricity, followed by wind, nuclear (including large and small reactors) and hydro. Together, renewables’ share rises from 41% today to up to 58% by 2030 and up to 90% by 2050, depending on the scenario. “But any number of challenges – from the supply chain, critical minerals supply, permitting and power grid expansion – could dampen aspirations for renewables capacity,” said Sharma.

Energy transition technologies are three-to-five times more metals intensive and often require different materials than legacy commodities, such as lithium, nickel, cobalt and rare earth elements. Battery demand rises five- to ten-fold in the base case and net zero scenario, respectively, by 2050.

Meanwhile, nuclear’s ability to supply zero-carbon electricity round-the-clock is finding favour with technology companies building data centres capacity. Policy support for both new power projects and uranium supply has expanded over the past year. The opportunity is huge, but the nuclear industry will need to overcome its cost and chronic project delays to stay competitive with other forms of power generation. Wood Mackenzie projects nuclear capacity to double in its base case and triple in its net zero scenario by 2050, compared with 383 GW last year.

Fossil fuels plateau and then begin to decline in the 2040s

“Despite strong growth in renewables, the transition has been slower than expected in certain areas because many low-carbon technologies are not yet mature, scalable, or affordable,” said Sharma. “A key constraint is the high cost of low-carbon hydrogen, CCUS, SMR nuclear, long-duration energy storage, and geothermal. Capital intensity is high, but the business case is weak without incentives.”

This challenge comes at a time of strong energy demand growth. As renewables alone will not be able to meet future energy needs in most markets, oil and gas is projected to continue playing a role in the global energy system to 2050.

Challenges in commercialising low-carbon energy development come at a time of strong energy demand growth. Renewables alone will not be able to meet future energy needs in most markets. Oil and gas are, therefore, projected to continue playing a role in the global energy system to 2050.

“Our analysis shows that with demand resilient, investment in upstream will be needed for at least the next 10 to 15 years to offset the natural depletion in onstream supply,” said Sharma. “Capital requirements for oil and gas increase significantly in the delayed transition scenario, in which costs of new technologies fall slowly, and policy support remains muted.

Meanwhile, liquids demand peaks at 106 mb/d by 2030 in the base case, but that comes with a 12% variation on either side, depending on the scenario. That highlights the degree of uncertainty for the oil and gas industry, driven by the pace of penetration of EVs in road transport, e-fuels in shipping and aviation, and industrial heat pumps. Demand stays high at 100 mb/d levels until 2047 in the delayed transition scenario but in a net zero world, falls rapidly to 32 mb/d by 2050.

Innovation improves commerciality of carbon capture and hydrogen

More than 1,200 projects have been announced in both the CCUS and hydrogen sectors in the past five years. However, few have taken FID yet due to a lack of policy certainty and high costs. Projects moving into development have an equity-adjusted IRR of well below cost of capital without subsidies. In contrast, upstream oil and gas projects remain attractive at 15% IRR or even higher at an industry planning price of US$65/bbl Brent long-term. Capital allocation and finance continue to favour oil and gas projects in the base case.

The dynamics change completely under the pledges and net zero scenarios, where a combination of higher carbon prices and faster cost declines of new technologies erodes the competitiveness of fossil fuels. This results in higher demand for low-carbon energy sources and improved profitability.

As a result, uptake for carbon capture and low-carbon hydrogen will climb to 6 Btpa and 0.45 Btpa by 2050.

A crucial decade ahead

The first global stocktake (GST), concluded at COP28 in November 2023, required that countries raise their ambitions in the next round of nationally determined contributions (NDC) submissions, due in 2025. The GST also found that no major country was on track to meet its 2030 goals. That leaves an opportunity both for course correction in the next NDC round and for higher emissions-reduction goals for 2035.

The GST emphasised the importance of protecting land ecosystem and addressing biodiversity loss, including by halting and reversing deforestation by 2030.

“But this will not be easy without increased cooperation at the COP29 meeting in Azerbaijan in November 2024,” said Sharma. “Key issues include finalising Article 6 of carbon markets and setting a new global climate finance goal that replaces the existing US$100 billion a year. That figure was not achieved until 2022 and is considered grossly insufficient to meet the needs of the developing countries.

“Strengthened NDCs and global cooperation will be crucial to mobilise US$3.5 trillion annual investment into low-carbon energy supply and infrastructure, including critical minerals. If these challenges can’t be overcome, the goal of net zero emissions by 2050 will not be achieved. Among the implications of a delayed transition are the worsening effects of global warming that will force governments not only to invest in mitigation but spend much more on adaptation.”

About Wood Mackenzie’s Energy Transition Outlook analysis

Wood Mackenzie’s Energy Transition Outlook report (part of our Energy Transition Service) maps four different routes through the energy transition with increasing levels of ambition – but also difficulty and investment. They are our independent assessment of what it would take to deliver on countries’ announced net zero pledges and potential outcomes for the planet.

You can read more information here and a copy of the analysis is available on request.

Definition of scenarios:

Base case - Wood Mackenzie’s base case view across all commodity and technology business units – our central, most likely outcome.

Country pledges scenario - Wood Mackenzie’s scenario on how country pledges may be implemented in the future. The 2°C trajectory aligns with the upper temp limit from the Paris Agreement.

Net zero 2050 scenario - Wood Mackenzie’s scenario on how a 1.5°C world may play out over the next 25 years. Carbon emissions align with the most ambitious goal of the 2015 ?Paris Agreement.

Delayed transition scenario - Assumes a five-year delay to global decarbonisation efforts due to geopolitics and reduced policy support to new technologies.

For further information please contact Wood Mackenzie’s media relations team:

- Source:

- Wood Mackenzie Ltd.

- Author:

- Mark Thomton

- Email:

- Mark.thomton@woodmac.com