News Release from windfair.net

Wind Industry Profile of

Cost explosion of offshore wind power causes problems worldwide

The champagne corks were still popping recently at the German Federal Ministry of Economics: The latest auction of licenses for the operation of offshore wind farms ended with a fat plus totaling 12.6 billion euros. Elsewhere, however, this news caused long faces, because the contract was awarded to BP and Total, two oil companies that had previously made their money mainly from the use of fossil energy. According to German media Handelsblatt, established offshore project developers such as RWE, Ørsted and consortia of EnBW and Equinor as well as BayWa and EDF had also bid. However, they were unable to prevail against the cash-rich oil multinationals.

In this case, it is primarily the potential buyers of offshore wind power who lose out, because the operators will later return to them the already considerable expenses incurred before even a construction permit has been issued - which contradicts the actual idea of the German government to make the expansion of offshore wind power as inexpensive as possible.

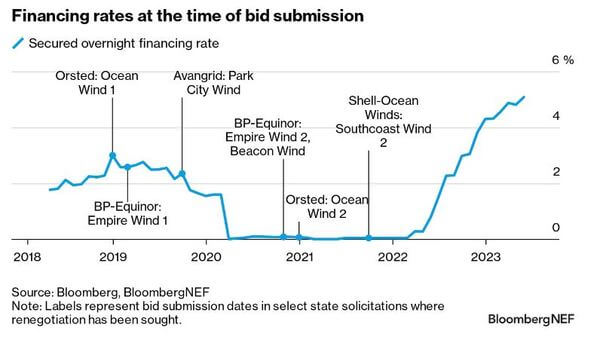

But it's not just special bidding procedures that are responsible for the massive price increases for offshore wind power in recent months. In the U.S., the situation doesn't look much better at the moment: Rising project costs, delays in permitting and hurdles in grid connection are leading to low returns. Inflation and supply chain issues have driven up capital spending, while financing costs have skyrocketed due to rising interest rates, BloombergNEF reports. As a result, project developers are renegotiating power purchase agreements they signed months ago that are now no longer profitable, while some are even canceling their contracts altogether.

For example, Avangrid, the U.S. subsidiary of Spanish energy company Iberdrola, recently pulled out of the Commonwealth Wind offshore wind farm, which is already under construction, entirely - despite a $48.9 million penalty due to the state of Massachusetts. That puts Avangrid in good company though.

"We are in the midst of renegotiating our PPA (power purchase agreement) contracts in the East Coast with our partner Equinor," BP CEO Bernard Looney told analysts just Tuesday, according to Reuters. At issue are the planned U.S. offshore wind farms Empire and Beacon, with a total capacity of 3,300 megawatts. And Danish offshore specialist Ørsted didn't fare much better last month, with Rhode Island's largest utility, Rhode Island Energy, pulling out of the Revolution Wind 2 offshore project due to rising costs.

In the US, prices for offshore wind have risen massively since the auctions took place. This is now causing distortions in the market (Graphic: BloombergNEF).

For example, according to BloombergNEF calculations, the cost of electricity for a subsidized U.S. offshore wind project has risen to $114.20 per megawatt-hour by 2023, an increase of nearly 50% from 2021 levels. Also to blame is an increase in material, labor and logistics costs. No wonder many companies are now getting cold feet.

However, this development is not limited to the American market. In Europe, too - where the cradle of offshore wind power is located - costs are currently causing problems in many places. Last week, for example, Polenergia, after all the largest private power generation company in Poland, announced its withdrawal from the planned auction of offshore wind areas in the Baltic Sea off Lithuania.

"The above decision was made after analysing the economic viability of the Project in the light of the published parameters regarding the planned auction (including the maximum transaction price announced by the National Energy Regulatory Authority (NERC) on July 13, 2023) and after consultations and in agreement with the Lithuanian company Modus Energy AB (operating under the Green Genius brand), which was to act as a local partner in the Project. Thus, the parties agreed that cooperation in this area ended," the company's statement said. Although the company wants to continue to be active on the Lithuanian market, the general conditions must be right for this to happen.

This development comes at an inopportune time for the industry, because actually the continuously falling costs in recent years had finally ensured that more and more countries had expressed interest in developing an offshore wind market. It remains to be seen how those market will now deal with the current developments.

- Author:

- Katrin Radtke

- Email:

- press@windfair.net

- Keywords:

- offshore, market, costs, explosion, pull out, prices, wind power, green, capacity, Germany, USA, developer, PPA, permit, delay