News Release from windfair.net

Wind Industry Profile of

Investment in Energy Transition Booms - Despite COVID-19

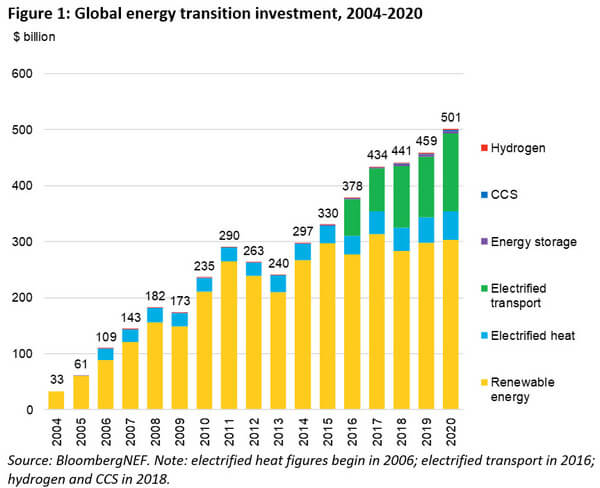

A new analysis by BloombergNEF (BNEF) shows that investors worldwide didn't let COVID-19 stop them from investing their money in the energy transition in 2020. In fact, a record US$ 501.3 billion was raised for 2020, a 9% increase on 2019.

In 2020 companies, governments and households invested $303.5 billion in the expansion of renewable energies alone, an increase of two percent over the previous year. In particular, solar capacity expansion was at an all-time high. But offshore wind power also played its part: the $50 billion invested represents a 56% increase. The investment in the 2.5 GW Dogger Bank wind farm in the British North Sea alone amounts to 8.3 billion dollars.

BNEF CEO Jon Moore said: “The coronavirus pandemic has held back progress on some projects, but overall investment in wind and solar has been robust and electric vehicle sales jumped more than expected. Policy ambition is clearly rising as more countries and businesses commit to net-zero targets, and green stimulus programs are starting to make their presence felt. Some 54% of 2016 emissions are now under some form of net-zero commitment, up from 34% at the start of last year. This should drive increasing investment in the coming years.”

The increase in investments in the energy transition becomes clear in the long-term view (Graphic: BloombergNEF).

However, Albert Cheung, head of analysis at BNEF, urged: "We need to be talking about trillions per year if we are to meet climate goals.” This is because investments vary greatly from region to region: While Europe has reached its highest level since 2012 with $81.8 billion (+52%) and almost caught up with China with $83.6 billion (-12%), investments in the U.S. in wind energy alone have fallen by 20% to $49.3 billion. The figures for India look similarly bad.

Certainly, the respective political situation plays an important role in addition to the pandemic. The US withdrawal from the Paris Climate Agreement under Donald Trump is one of the first measures that new President Joe Biden wants to reverse. However, Sascha Lafeld, Head of Carbon Offset & Green Energy Services at Climate Partner, points out the fundamental uncertainty in the country at the moment: "What exactly the US can contribute to global climate protection in the future will have to be completely renegotiated domestically, as the original American targets have become invalid as a result of the withdrawal from the agreement. On the one hand, this brings uncertainty, but at the same time it is also an opportunity for the Americans to gain a leading role in international climate protection."

The offshore market is booming among investors (Image: Pixabay)

Germany, until now an industrious driver of the energy transition, was last year mainly under the impression of a reform of the Renewable Energy Sources Act (EEG), which dragged on until the end of the year. In this respect, investments were moderate at $7.1 billion, an increase of 14%. Since a new government will be elected in 2021, it remains to be seen how the situation will change under the influence of the election campaign. The parties are currently positioning themselves, as a statement by e.g. Matthias Miersch, vice-chairman of the SPD parliamentary group in the Bundestag, shows. The SPD, currently a government partner in the Grand Coalition, is threatened with a debacle in the election, while the Greens, according to the polls, have good chances of a possible coalition with Angela Merkel's CDU. Miersch took a shot at the Greens, which are currently co-governing several federal states in Germany, in the Handelsblatt: "It is obvious that the obstacles to expansion lie in different spheres of responsibility and thus also with the federal states - often co-governed by the Greens." However, he was selective in his approach and concealed the fact that among the federal states where the expansion of renewable energies is lagging behind are also some SPD-led ones.

In addition to these internal disputes, the global view mustn't be forgotten, as emerging and developing countries in particular have a key role to play, as the International Finance Corporation (IFC) of the World Bank emphasised. Thus supporting low-carbon investments in 21 selected emerging economies alone in the post-COVID recovery has the potential to generate US$10.2 trillion in investment opportunities, create 213 million jobs and reduce greenhouse gas emissions by 4 billion tonnes by 2030.

This will not only boost the post-Corona economic recovery, but also help reduce the disproportionate impact of climate change on the world's poorest and most vulnerable people.

- Author:

- Katrin Radtke

- Email:

- press@windfair.net

- Keywords:

- energy transition, investments, 2020, recovery, pandemic, global, BloombergNEF, Germany, USA, Joe Biden, offshore, solar, boom, COVID-19